Porinju Veliyath 14th October 2024

Is market likely to come down?... Freaking out about short-term market drawdowns is a perennially losing proposition…

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” - Peter Lynch

Legendary Investor Peter Lynch’s thoughts on losses in the stock market are still relevant today. When we interact with common folks or experienced analysts, we find too much energy and time being allocated in looking for reasons for next correction. Most of the time, it is our internal emotional demon which is the hindrance rather than some fundamental reality of corporate earnings or discounting of those earnings. Corrections are normal and bound to occur. What is futile is to keep anticipating them and fall trap to common mistakes a lot of investors make – to exit early or to keep waiting to enter market on sidelines!

Warren Buffett puts eloquently in 2020 Annual report the following: “Productive assets such as farms, real estate and, yes, business ownership produce wealth – lots of it. Most owners of such properties will be rewarded. All that’s required is the passage of time, an inner calm, ample diversification and a minimization of transactions and fees.”

In the above lies a very profound wisdom – which is that – productive assets generate cash and they deploy those to earn more cash, which over time becomes wealth. Investors in paranoia of short term noise and news ignore this simple fact of productive assets. Time is friend of “ownership of business” - the simple reality most investors fail to internalise.

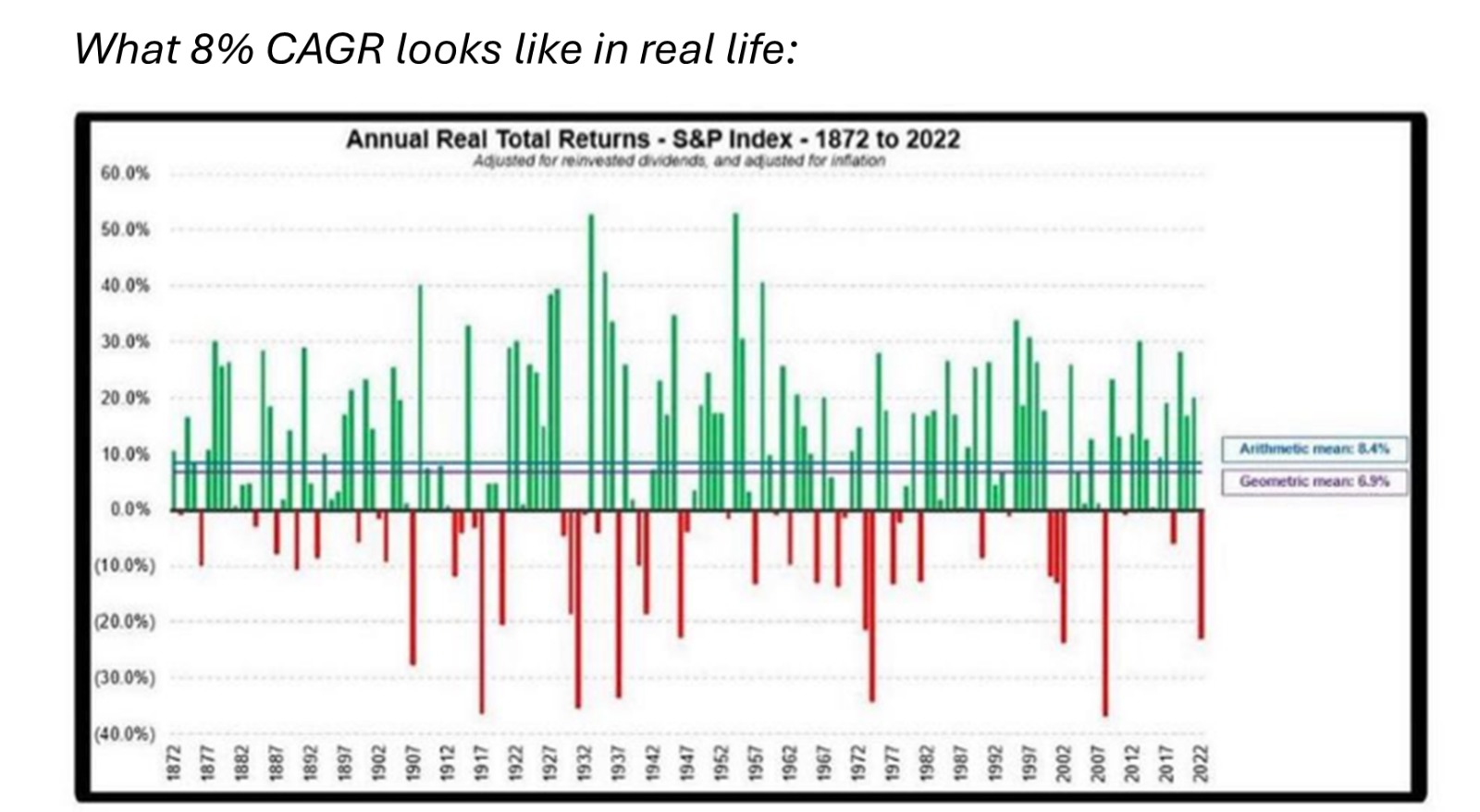

Here is another simple reality of compounding and time factor that we encourage investors to take home…

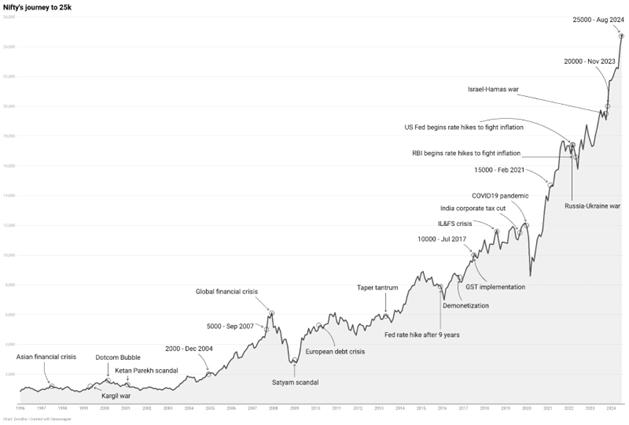

Both graphs above depict the same reality. However, investors who are glued to annual or worse daily ups and downs (as captured by second graph) are bound to, at some point, get swayed by “timing disease”. Whereas those investors who look at wealth and businesses, as captured by first graph, would make “time spent as a pill for cure”. It is same reality being perceived differently with the lens of time. We encourage our fellow travellers on this wealth creation journey to pause, think and internalise this picture.

As Charles Ellis says - “Investors would do well to learn from deer hunters and fishermen who know the importance of ‘being there’ and using patient persistence—so they are there when opportunity knocks.”

Nifty’s Journey to 25000 – journey of climbing walls of worries!...

Investment team at EQ has several members who have lived through these 25 years and learnt the hard way framework or mindset to adopt for being successful at long term investing. One could have had faith on equity ownership of Indian businesses and stuck through all ups and downs and the result would be fantastic or someone could have wasted several years worrying about some crises or factors every few years through these 25 years. Please note – next 25 years may not be too different. Nifty will keep compounding for some while others will keep getting paranoid about some news of crises or anticipate one coming.

Following para from Thomas Phelps’s book “100 to 1 in the Stock Market” beautifully captures this human emotional urge for seeking immediate gratification based on some emotional hunches versus adhering to long term sound investing plan overcoming such emotion bursts.

“The conclusion seems inescapable that if we buy right, no amount of trading or switching thereafter is likely to produce results equal to what he can have by simply holding on. By doing so he avoids paperwork, brokerage commissions and capital gains taxes. He loses fun of trading, of matching his hunches about what market will do tomorrow against the hunches of everyone else who is trading, the self-satisfaction of making a fast buck out of thin air. “

Truth is that money management is a lot more than just stock picking. It is uncovering some ground principles of wealth over time and sticking to them. It is a lot about understanding some of our own emotional and cognitive biases which blind us in long term success. It is a lot of reinforcing of some wise habits and staying away from some stupid ones.

Economic expansion that India is likely to witness going forward is massive and longevity looks robust broadly

India's economic environment remains robust and flourishing both internally and externally. All key indicators from GST collection, E-way bills, IIP Growth YoY, Composite PMI, and credit growth suggest economic activity have improved. On the fiscal front, the government has maintained prudence by reducing its deficit target and targeting lower debt-to-GDP ratio. It is confident in boosting revenues through strong demand and improved tax collections, while continuing to prioritize spending on rural development, employment, and infrastructure. Moreover, banking credit to the industry segment grew at its fastest pace in a year with medium-sized firms being the greatest beneficiaries. Our reading of ground level corporate activity, consumer sentiments and governance initiatives makes us believe that India will continue to thrive.

This doesn’t mean there are no challenges. We resonate with concerns about rising inequality, job creation challenges, and persistent infrastructure constraints, particularly in urban areas. While India benefits from a growing middle class and a burgeoning technology sector, a large portion of the population still lives in poverty and lacks access to basic services and are locked in low productive Agri economy. Without addressing these issues, India risks widening the gap between the rich and poor, potentially undermining social stability and hindering its long-term economic prospects.

We keep eyes and ears open about socio-economic environment just like any entrepreneur would do. Entrepreneurs go to work daily and do not quit because of some macro-economic challenges or technology disruption or policy changes affecting adversely but thrive despite with their ingenuity, focus, persistence and patience.

Good, Bad and Ugly - All co-exist most of the time

Any market at any point in time would have potential compounding opportunities to invest long, offer some cyclical turnarounds or landmines which could evaporate our capital. Investors responsibility is to keep looking for opportunities and keep away from landmines. Ratio of opportunities to landmines may differ but both exist all the time. We continue to find opportunities in current markets.

We re-iterate broad mindset for investors that we articulated in our last communication and encourage to keep investing / re-investing capital, have faith in the potential of Indian economic prosperity and power of equity as an asset class to generate long term wealth.

For the first half of FY25 EQ PMS is up 36.5% vs 16.6% Nifty. Best time to invest was yesterday. Next best time is today.

Regards,

Porinju Veliyath